Chinese firms are accelerating the adoption of open-source AI models across Africa, providing startups and innovation hubs with powerful, low-cost tools to drive local innovation without the heavy financial burdens of proprietary Western alternatives.

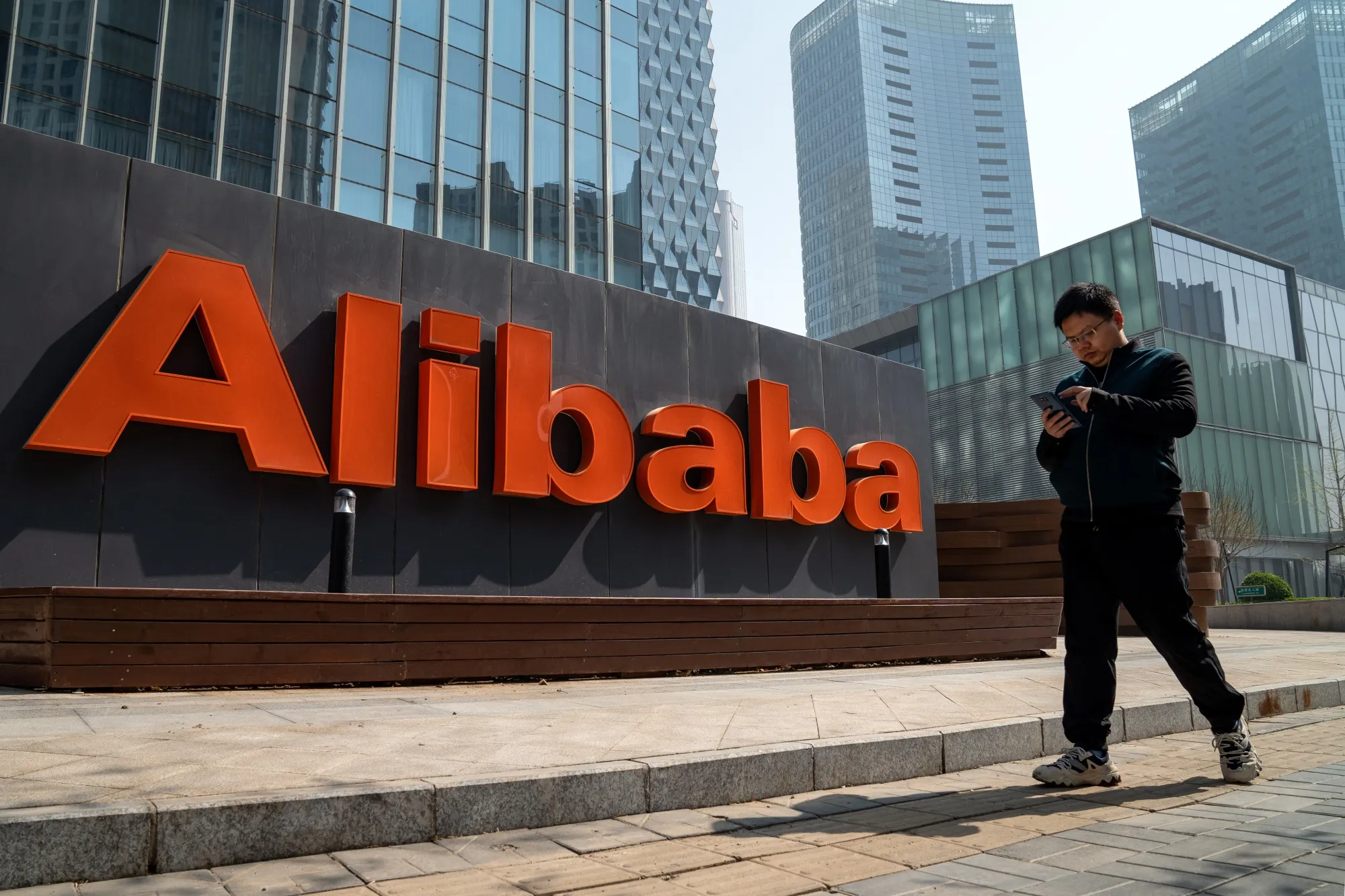

Major players like Alibaba Group and Huawei Technologies are leading this push. Through initiatives integrated with their cloud infrastructure such as Alibaba Cloud’s regional deployments and Huawei Cloud they are actively promoting models like Alibaba’s Qwen series and collaborations involving DeepSeek. These open-weight or fully open-source large language models (LLMs) allow developers to download, fine-tune, modify, and deploy AI solutions freely, often at fractions of the cost associated with closed systems from companies like OpenAI or Google.

Recent coverage, including reports from China Daily, highlights how this strategy is reshaping Africa’s AI landscape. Chinese vendors bundle these models with affordable cloud computing, training programs, and incubators tailored to African entrepreneurs. Startups in Nigeria, Kenya, South Africa, and beyond can now access high-performance AI without prohibitive API fees. Cost comparisons are striking: processing large volumes of data or tokens can cost significantly less sometimes $1-2 for what might run $20 or more with leading U.S. proprietary models making experimentation and scaling feasible for resource-constrained teams.

Social Commerce Market Size, Drivers & Opportunities, Outlook 2025 … African founders are increasingly vocal about the advantages. These models offer flexibility, dramatically lower costs, and greater potential for local data sovereignty. They enable customization for African languages, cultural contexts, and sector-specific needs such as agriculture tech, healthcare diagnostics, fintech solutions, or small-to-medium enterprise tools while reducing dependency on expensive foreign APIs.

This approach aligns with broader efforts like China’s Digital Silk Road, where AI is packaged alongside infrastructure including 5G networks, data centers, and energy solutions. Alibaba Cloud has established local public cloud zones (for example, in Johannesburg with partners), and Huawei maintains a strong regional presence in countries including South Africa and Egypt. These setups reduce latency, improve accessibility, and support on-device or edge computing critical in regions with variable internet connectivity.

Asia Pacific Synthetic Media Market Size, Share & 2030 Growth.

The appeal goes beyond economics alone. Open-source models foster genuine local innovation by allowing startups to build sovereign, tailored applications rather than relying on black-box foreign systems. This democratizes AI access, helping bridge the continent’s digital divide and

empowering homegrown solutions across key sectors like education, finance, agriculture, and beyond.

However, the trend sparks debate. Some observers express concerns over data privacy, potential security risks from foreign-hosted infrastructure, and the possibility of growing geopolitical dependencies as Chinese tech embeds deeper into African digital ecosystems. Experts often foresee a hybrid future: one that blends these affordable open models with selective use of Western tools, while African developers, governments, and institutions invest in building indigenous AI capacity.

As of January 2026, this wave of open-source AI promotion from Chinese firms continues to gain momentum. It positions Africa not merely as an adopter of technology, but as a potential hub for cost-effective, context-aware artificial intelligence innovation. With traditional barriers to entry rapidly crumbling, the continent’s startups are well-placed to leapfrog conventional development paths and create solutions genuinely built for African realities.